Pay My Bill

Select the St. Elizabeth organization you received care.

St. Elizabeth Physicians

Paying your bill is easy with the St. Elizabeth Physicians online Patient Bill Pay System. While you can still pay by mail or over the phone, many people prefer the convenience of paying online anytime—24/7. It’s quick, simple, and designed to make your life easier.

Bank Account Cards or Credit Cards Accepted:

If you have a question about your bill, contact our customer service representatives.

Phone: (859) 344-5555

Hours: 7:30 a.m. – 5:00 p.m., Monday through Thursday and 7:30 a.m. and 4:00 p.m. on Friday.

Paperless Billing Notice. Starting April 2, 2025, patients who have an active MyChart account will be auto enrolled in paperless billing and will no longer receive bills in the U.S. mail. To opt out of paperless billing, please log into the MyChart App. Visit the MyChart App.

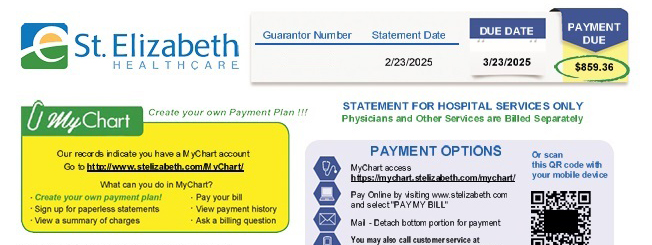

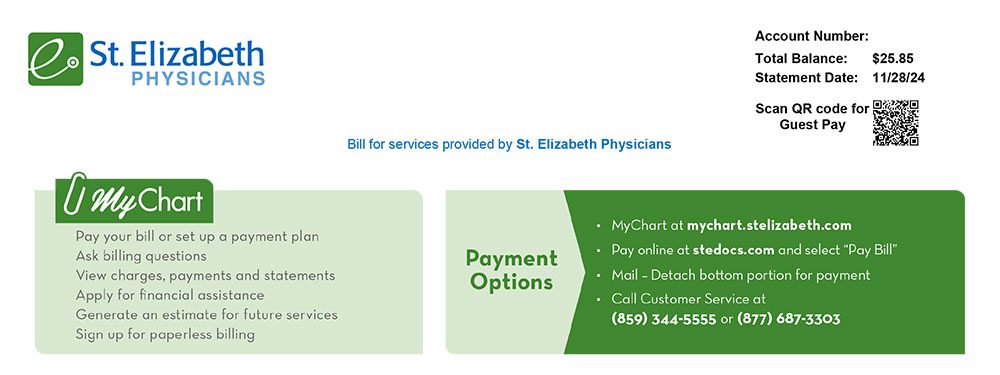

What Does Your Bill Look Like?

To find out which St. Elizabeth organization provided your care, check the paper screenshots below. You can also see the organization listed under paperless billing in MyChart.

If you have a question about your St. Elizabeth Healthcare bill, contact our customer service representatives.

Hours Mon – Fri: 8 a.m. – 4:30 p.m.

If you have a question about your St. Elizabeth Physicians bill, contact our customer service representatives.

Hours Mon-Thu: 7:30 a.m. – 5 p.m., Fri: 7:30 a.m. – 4 p.m.

St. Elizabeth Physicians Billing Resources

- Individuals and families having a remaining balance after their insurance has processed a claim, or

- Individuals and families who are uninsured.

- Print the Financial Hardship Application from our website

- Pick one up at your physician’s office

- Call our customer service department at (859) 344-5555 or toll-free at (877) 687-3303.

- You can mail in your application to St. Elizabeth Physicians Attn: FHA PO Box 630839 Cincinnati, OH 45263

- You can fax your application to (859) 795-5461

- You can email your application to [email protected]

- You can turn in your application at any of our office locations.

- Before any financial hardship is granted, you must exhaust all other sources of payment including insurance.

- Family income in relation to income guidelines

- Patient must be a United States citizen or legal resident.

- If you are claiming that you have no income, please provide a notarized explanation of how you are obtaining food, housing, etc.

- If you reside with someone who provides for you, you must submit their income information.

- Three consecutive check stubs (including current employment, child support, unemployment, workers compensation, etc.).

- Food stamp letter

- Previous year’s tax return

- Social security or disability benefit letter

- If self-employed, a financial statement of gross income fewer business expenses on company letterhead and notarized.

- If you are a nursing home resident, please send proof of residency and power of attorney (POA) papers.

- By Mail – Please detach the bottom portion of your billing statement and include it with your payment in the envelope provided. St. Elizabeth Physicians P.O. Box 630839 Cincinnati, OH 45263. Please note guarantor number on payment for proper allocation.

- By Phone – We can accept credit card payments over the phone. Please have your account number available to expedite the process. Call our customer service department at (859) 344-5555 Monday through Thursday 7:30 a.m. – 5 p.m. and Friday 7:30 a.m. – 4 p.m.

- In Person – Payment can be made at any St. Elizabeth Physicians location or at our Central Billing Office. See a complete list of all our locations at stedocs.com by clicking on Our Locations

- Online – stedocs.com by clicking on Bill Pay.

- My Chart – Visit mychart.stelizabeth.com/mychart If you are not a current user or do not have an access code, contact your physician’s office to be assigned an access code.

- We record email contact information strictly for our internal use. We do not sell or distribute personal information.

- We send confirmation emails regarding payments and certain types of maintenance. Confirmation emails help guard against fraudulent use of the system.

- We record your use of the system to the extent we are aware of when log-in occurs. We also keep statistics about how the system is used. This information helps us plan better services and improve system performance.

- We use encrypted transmission (Secure Socket Layer – SSL) for all transactions on our billing site.

- We use cookies for our internal use only. They are required to maintain session information.

- We do not share cookies with any outside agency.

- We do not place shared cookies or customer profiling banner ads on our pages.

- We do not retain credit card information (unless you specifically tell us to for your convenience) except for audit trails which are used to prove transactions. The audit trails have portions of the card number marked out for enhanced privacy.

- The Transaction Account does not contain sufficient funds to complete the transaction, or the transaction would exceed the credit limit applicable to the Transaction Account.

- You have not provided St. Elizabeth Physicians with correct names or account information.

- Circumstances beyond St. Elizabeth Physicians’ control (such as, but not limited to, fire, flood, or interference from an outside force) prevent the proper transmission of your payment authorization and St. Elizabeth Physicians has taken reasonable precautions to avoid those circumstances.

- St. Elizabeth Physicians fails to receive a full and complete payment authorization.

- You have made any false or materially misleading statement or representation in connection with any payment authorization.

- The bank or financial institution maintaining the Transaction Account refuses or is unable to honor a payment request from St. Elizabeth Physicians.

St. Elizabeth Physicians Billing FAQs

- You must be using 128-bit encryption, and it must be turned on in your browser. (See your browser’s online help for more information.)

- Javascript must be enabled in your browser. Normally, it’s turned on by default, although you can disable it. (See your browser’s online help for more information.)

- Internet Explorer 4.5 for Macintosh. This browser has problems that may cause this site not to function properly. We recommend Macintosh users who wish to use IE upgrade to the most current version.

- IE Version 4 may work satisfactorily. However, 128-bit encryption (also called strong encryption) was not included in all releases of Internet Explorer Version 4. To avoid this problem, we recommend IE users upgrade to the most current version.

- Netscape Navigator and Netscape Communicator lower than Version 6. These browsers do not follow web standards for dynamic content. To avoid these problems, we recommend Netscape users upgrade to the most current version.

Contact Us

Call Us

Mail Your Payment

St. Elizabeth Physicians

Cincinnati, OH 45263

Office Hours:

Monday – Thursday: 7:30 a.m. to 5 p.m.

Friday: 7:30 a.m. to 4 p.m.